|

Listen to this article

|

Whiz is SoftBank’s best-selling cleaning robot. | Credit: SoftBank

SoftBank Robotics America (SBRA) is partnering with Formant, a leading developer of robot management systems. Formant’s cloud platform helps robotics companies deploy, scale, and manage their fleets. It also provides data to end users to help prove the ROI of their robots.

The partnership will drive deeper integration across the portfolio of SoftBank’s cleaning robots. Formant will help build the basis for mixing artificial intelligence, advanced business intelligence, and more software services. Softbank said this will help its customers get the most out of their investments in robots.

“SoftBank Robotics has proven that technology, data, and white glove support are the core of driving measured business value and service with this industry,” said Brady Watkins, president, SoftBank Robotics America. “This partnership with Formant allows us to evolve our solutions with new and innovative services that deliver enterprise-grade automation at scale. The focus of the resulting solutions will be to allow our clients to provide more integrated services to their end users.”

SBRA is adding the new Vacuum 40, a commercial robot vacuum from Gausium, to its lineup of cleaning robots. The Vacuum 40 is the third robot vacuum offered by SBRA; the two others are the Whiz Vacuum and Guasium’s Scrubber 50 Pro.

In October, Formant raised $21 million in funding. 2023 has been a record year of growth for Formant. At the time of this funding round, it said it had already increased revenue by more than 500% year-over-year. Formant said much of its growth has come from blue-chip enterprises like Blue River Technology, a subsidiary of John Deere, and BP. It has also come from leaders in the robotics industry like Burro, Scythe, and Knightscope.

I spoke to Formant CEO and co-founder Jeff LInnel to learn more about this partnership with SoftBank and how Formant’s technology is evolving to fit the needs of customers like SoftBank.

Mike Oitzman: Softbank claims to have deployed 20,000 robots worldwide. I assume you’re not bringing 20,000 endpoints into a single pane of glass and that this large fleet will be broken down regionally and by individual customer fleets?

Jeff Linnell: I can’t get specific about the numbers. However, SoftBank is starting to deploy its systems at a real scale. They’ve been doing this for years and years. Different entities have different numbers in their fleets but, fleet scales could be between five and 500, or 1000s. However, their regional deployments are tiered and roll up at different levels. Indeed, the rolled numbers of robots are in the 10s of 1000s of units.

Within the different SoftBank customer regions, there are different technical requirements. Things like the distinction between an enterprise customer and an SMB customer, and the needs of RaaS businesses and what they need to support them. There may be completely different requirements. This includes features like: How do I use the graphing? What types of visualizations are important? It’s what are the GDPR requirements? What is the latency required around the world? How do I deal with enterprise requirements like SSO or key global integration? A lot of this is really technical stuff.

When a SoftBank customer switches from Whiz Connect to the new platform, are they switching out of the legacy solution and onto the (white labeled) Formant platform?

Essentially, yes. Formant is an internal tool used by technical teams to manage their field-deployed robots. The new software platform is a technical tool, but it’s not as technical as former traditional interfaces. It is far more customer and user-facing delivering the right amount of information to the right person. So that’s a distinction.

Historically, Formant has been very horizontal. Customers are always pulling us towards powering their applications that are tailored or white-labeled. This a trend that we see. So we anticipate doing more and more work where you’re looking at our data infrastructure visualized in different ways, and represented that is specific to whoever it is that needs to leverage that.

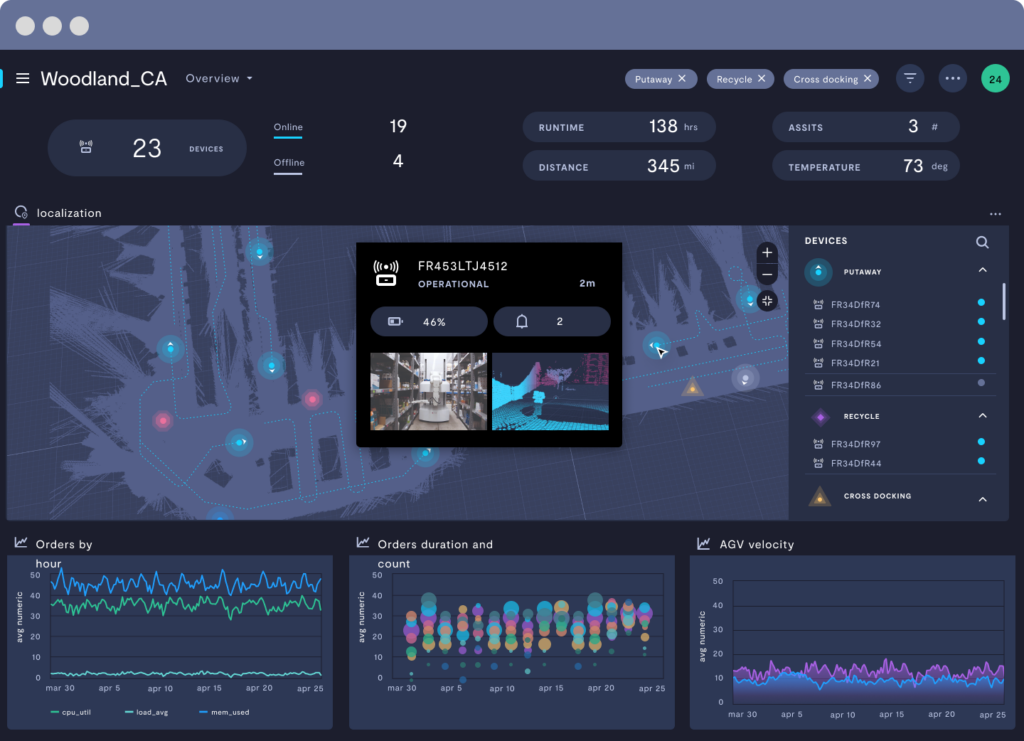

Customers can leverage Formant’s cloud infrastructure, data management, and security to scale their fleets. | Credit: Formant

So the Formant solution is evolving to not only support the needs of the internal support team for monitoring and managing deployed robots, but also to support the needs of end users who operate the systems and the operations managers who manage the end users and fleets of robots?

Correct. We’re starting to see that stratification and the different interfaces that people want, we’ve always known that was coming, but this is a very clear example of having different visual interfaces, different levels of access, and technical granularity for different users. So, the roboticists at SoftBank are going to be looking at very different things and can do that all through Formant and go back and do root cause analysis, all this sort of thing. While the janitor does not want to get into that low level of analysis. They just want to know what’s broken needs to needs to be dealt with, or when the robot needs water or cleaning fluid replaced.

Why did SoftBank choose Formant for this functionality?

There are two reasons Softbank is interesting from a partner standpoint. One is scalability. We’ve got an infrastructure that is built to scale. This is a requirement because there’s a tremendous amount of monitoring and network investment to make sure that things are stable and scalable. That’s critical. It’s a huge vote of confidence that we’re chosen as a partner.

The other reason is that we’ve brought many types of robots onto our data platform. SoftBank is a “super integrator,” that provides software services, sales, robotics, and support to the industries they serve. As a SoftBank partner, we must be able to rapidly bring on new robotics systems, test them, and get them to scale. So that’s our key advantage, the scale and the ability to quickly bring up a new robotic system.

What you’re doing is similar to the virtual machines to cloud-based enterprise software evolution that happened over the last two decades, only Formant is doing something analogous for robots.

That’s right. Everybody’s coming up with new robotic solutions all the time, new iterations of them, and new companies are popping up with competing products. End users want to be nimble and not locked into a specific OEM, and this provides flexibility.

Tell Us What You Think!